Does United Health Care Cover Weightloss Surgery?

Let’s find out the answer to the “Does United Health Care Cover Weightloss Surgery?”question. United Healthcare insurance coverage can change based on a number of factors. Here are some of these things:

- Body Mass Index 35 and up (BMI),

- Recordings of your failed attempts to lose weight,

- A specialist should do a psychological evaluation

- Even if your insurance company has some plans that cover bariatric surgery, that doesn’t mean that your plan does.

Does United Health Care Cover Weightloss Surgery? In this article, we list the requirements for bariatric surgery approval, assuming that your private policy covers weight loss surgery. You can talk to a surgeon to find out if bariatric surgery is covered by your private policy. You can also just call your insurance company. In the U.S., you have to meet the following requirements:

- You have to be 18 or older

- Your doctor should tell you that you are morbidly obese

- Your Body Mass Index (BMI) must be over 40

Or, you must have a body mass index (BMI) between 35 and 39.9 and one of the following:

- Severe sleep apnea

- Pickwick syndrome

- Cardiomyopathy

- Type II diabetes

How Does United Health Care Cover Weightloss Surgery?

In a comprehensive weight management program, you should be checked out by endocrinologists, psychiatrists, surgeons, dietitians, and nurse practitioners. You can also apply to a Center of Excellence as defined by Medicare.

This program also helps people lose weight, gives them guidance and support when they exercise, gives them advice on what to eat, teaches them how to make changes to their lifestyle, prepares them for surgery and checks on them afterward, and should have support groups for people before and after surgery.

Teenagers who want to have surgery for morbid obesity must weigh as much as an adult. But the psychosocial, informational, and consent forms that will be made for teens get more attention.

What Should You Do If United Health Care Doesn’t Cover Weightloss Surgery?

You can ask for partial coverage if your policy doesn’t cover bariatric surgery. Even if your insurance doesn’t pay for all of the weight loss surgery, it will be able to cover some of the costs. The most important thing is that your doctor and hospital talk to your insurance company.

For example, a cardiology test doesn’t need the CPT code for weight loss surgery. Your insurance will pay for services like sleep testing if they need lab work, a diet plan, or a psychological evaluation. But your doctor will code your surgery to lose weight. These claims will not be covered by CPT insurance. But if your doctor uses a generic CPT code, it’s likely that they will meet it.

Even though it doesn’t look like it, this is a moral thing to do. Even if you decide not to continue with surgery, you will still need these services.

Does Blue Cross Cover Weight Loss Surgery?

HMSA Blue Cross Blue Shield covers weight loss surgery, but as we’ve already said, your policy must cover it for you to use it. Let’s look at a list of the different types of HMSA Blue Cross Blue Shield plans and see if any of them cover bariatric surgery.

After the Affordable Care Act was signed into law, all insurance companies in 23 states had to cover weight loss surgery for Individual Plans, Family Plans, and Small Group Plans (employers with fewer than 50 full-time employees). Here are the ways you can try to get your insurance to pay for bariatric surgery:

Even if you don’t want surgery, your surgeon can check for free to see if your insurance will cover it by calling your insurance company. Surgeons know how to get approval from insurance companies, so you can put your trust in them.

You can definitely talk to your insurance company on your own. And you should check your plan’s summary. For Health Plans Through Your Work, the rules for bariatric surgery coverage are the same as for individual or family coverage.

How To Get Financing For Weight Loss Surgery?

Your doctor can first contact your insurance company on your behalf. Also, giving up on surgery in the middle of the process doesn’t change anything. Your own doctor has a lot of say over how your insurance company approves things. Second, you can talk to your company’s Human Resources department about this problem.

You can always call your insurance company yourself, which is always a valid option. And make sure you have a Summary Plan Statement. Also, if you meet all of the other requirements, Medicare will pay for the following procedures:

- Sleeve gastric surgery

- Surgery called gastric bypass,

- Surgery to put on a belly band,

- Open or laparoscopic biliopancreatic diversion with duodenal switch (BPD/DS)

What should you do if bariatric surgery is not covered by your insurance? If your insurance doesn’t cover weight loss surgery despite what we’ve listed above, it’s probably not in your policy. First, you should be sure by asking your surgeon. It will get in touch with your insurance company at no cost to you. Don’t worry, insurance companies are in touch with surgeons and their offices. So, they have a very good idea of how the process works.

Things To Consider About Weight Loss Insurance

If your surgeon says that your policy doesn’t cover bariatric surgery, you can ask for a tip to lower the cost. But you can find a lot of useful information about it on the internet. If these tips don’t help, we’d suggest that you change your insurance company or policy.

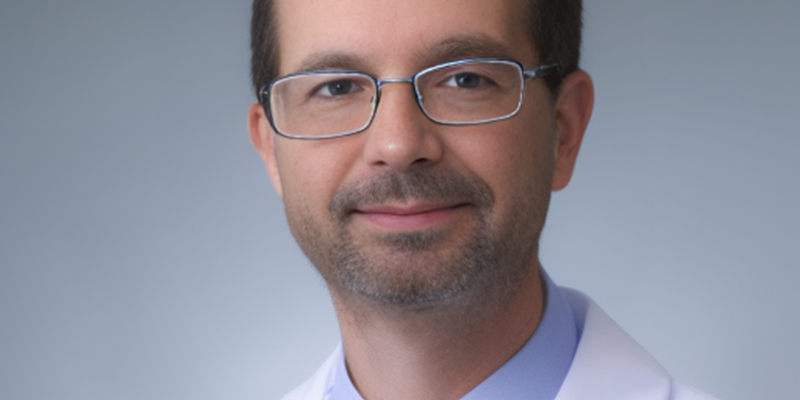

If you meet all of the above criteria, don’t worry, your insurance will pay for your surgery to help you lose weight. We’ve talked about some of the things you can do if you don’t. But if these don’t help, we suggest that you talk to your surgeon first. He knows everything you need to know about this.

Lastly, you can contact your insurance to get more specific and detailed information about this process. Because insurance companies can file each customer’s file separately, each one can be looked at and judged on its own. Don’t forget that your doctor and insurance company will always be ready to help you in the best way possible. You can always change it if you don’t like it.

Does United Healthcare Cover Weight Loss Surgery or Not?

Whether does United Healthcare cover weight loss surgery or not is a good question to think about when considering getting surgery for weight loss. United Healthcare does in fact cover weight loss surgery, although it is dependent on individual health plans. Patients who are considered good candidates for the procedures will most likely be approved for coverage under their United Healthcare policies. Additionally, United Healthcare works with a network of weight loss centers and surgeons to ensure patients receive the best possible care for their needs.

To determine if you are eligible for coverage of these services, it is important to speak with a healthcare provider or contact United Healthcare directly. As always, it is important to research all options available before making any final decisions regarding Whether does United Healthcare cover weight loss surgery. By doing so, you can properly understand all that is involved in your insurance policy and be sure you are making an informed decision when selecting a provider or deciding which treatments are right for you. If you have any other questions regarding coverage of weight loss surgery with United Healthcare, do not hesitate to contact them directly.